Super Guarantee Amnesty Resurrected

The Government has resurrected the Superannuation Guarantee (SG) amnesty giving employers that have fallen behind with their SG obligations the ability to “self-correct.” This time however, the incentive of the amnesty is strengthened by harsh penalties for those that fail to take action.

Originally announced in May 2018 and running between 24 May 2018 until 23 May 2019, the amnesty failed to secure its passage through Parliament after facing a backlash from those that believed the amnesty was too lenient on recalcitrant employers.

Since the original announcement, the Government reports that over 7,000 employers have come forward to voluntarily disclose historical unpaid super. The SG tax gap is estimated at around $2.85 billion in late or missing SG payments.

When does the amnesty apply?

Legislation enabling the amnesty is currently before Parliament and if enacted, will apply from the date of the original amnesty announcement, 24 May 2018, until 6 months after the legislation has passed Parliament. Employers will have this period to voluntarily disclose underpaid or unpaid SG payment to the Commissioner of Taxation.

The amnesty applies to historical underpaid or unpaid SG for any period up to the March 2018 quarter.

Qualifying for the amnesty

To qualify for the amnesty, employers must disclose the outstanding SG to the Tax Commissioner. You either pay the full amount owing, or if the business cannot pay the full amount, enter into a payment plan with the ATO. If you agree to a payment plan and do not meet the payments, the amnesty will no longer apply.

Keep in mind that the amnesty only applies to “voluntary” disclosures. The ATO will continue its compliance activities during the amnesty period so if they discover the underpayment first, full penalties apply. The amnesty also does not apply to amounts that have already been identified as owing or where the employer is subject to an ATO audit.

What do employers pay under the amnesty?

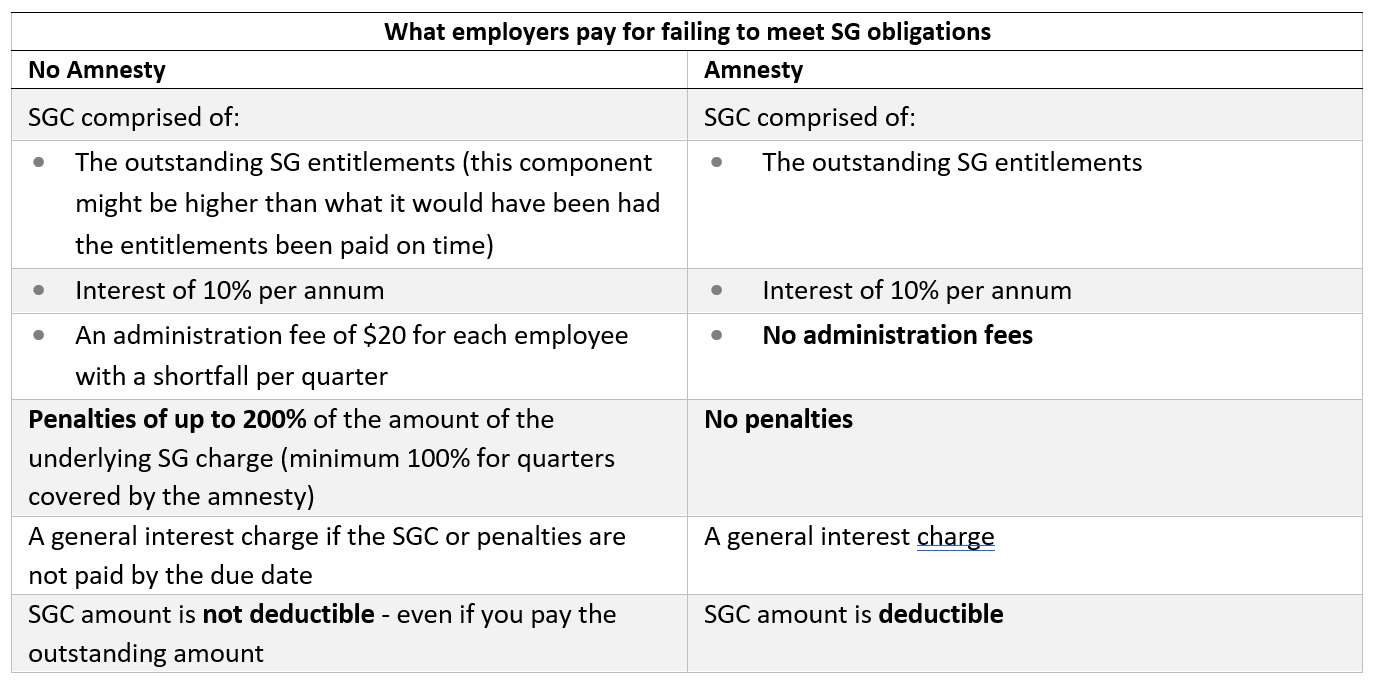

Normally, if an employer fails to meet their quarterly SG payment on time, they pay the SG charge (SGC) and lodge a Superannuation Guarantee Statement. The SGC applies even if you pay the outstanding SG soon after the deadline.

Under the quarterly superannuation guarantee, the interest component is calculated on an employer’s quarterly shortfall amount from the first day of the relevant quarter to the date when the SG charge would be payable (not from the date the SG was overdue).

The ability to deduct SGC and the reduction in penalties under the amnesty could be significant for employers that have fallen behind with their SG obligations.

If SG is paid late, special provisions exist within the legislation to automatically protect employees from inadvertently breaching concessional contribution cap limits if the unpaid SG is paid to the Commissioner and then transferred to the employee’s superannuation fund. Where the employer makes the payment directly into the employee’s fund, the individual would need to apply to the Commissioner requesting the exercise of discretion to either disregard the concessional contributions or allocate them to another financial year.

What happens if you do not take advantage of the amnesty?

If an employer fails to take advantage of the amnesty and is found to have underpaid employee SG, they are required to pay the SGC which includes penalties of up to 200%. Outside of the amnesty period, the ATO has the power to reduce the penalty in whole or part. However, the legislation enabling the amnesty imposes tougher penalties on employers that do not voluntarily correct underpaid or unpaid SG by removing the ATO’s capacity to reduce these penalties below 100%. In effect, the Commissioner loses the power for leniency even in cases where an employer has made a genuine mistake.

Where to from here?

Even if you do not believe that your business has an SG underpayment issue, it is worth undertaking a payroll audit to ensure that your payroll calculations are correct, and employees are being paid at a rate that is consistent with their entitlements under workplace laws and awards.

If your business has fallen behind on its SG obligations and is eligible for the amnesty, you need to start working through the issues now or contact us to work through the issues for you. There are several calculations that need to be completed and these may take some time to complete.

If your business has engaged any contractors during the period covered by the amnesty, then the arrangements will need to be reviewed as it is common for workers to be classified as employees under the SG provisions even if the parties have agreed that the worker should be treated as a contractor. You cannot contract out of SG obligations.

If a problem is revealed, you can correct it without excessive penalties applying under the amnesty. If you are uncertain about what award and pay rates apply to employees, the FairWork Ombudsman’s website has a pay calculator or you can contact them online or call them on 13 13 94.

If you need more information or have any questions please don’t hesitate to contact us